IHG One Advantages Options render 2,000 issues the 2 night or 8,100000 points all the 4 evening

The brand new comments on this page aren’t considering, examined, or else approved by the financial advertiser. That isn’t the bank advertiser’s duty to ensure all postings and/otherwise issues is responded. When you are taking an alternative job otherwise conversion process region, inquire about the earlier salesperson’s transformation results.

Secure 2,one hundred thousand POINTSEVERY dos Night

Sometimes, a link create been to without having any lifestyle words (NLL otherwise “Zero Existence Words”), enabling people that’d currently had the card to find a differnt one. Over the years, they certainly were rare, upcoming up to maybe once or twice per year. In the last two years, Western Show could have been barraging you that have unmatched welcome now offers to have both private and you may company types of the Silver and you will Rare metal bank cards.

Diamond Elite Pros

The new certificate otherwise trophy might be carefully and you may cleverly designed, and you will appropriate to your celebration. This type of prizes are occasionally along with an excellent token concrete prize, such a present certificate, a plus day from, otherwise a good parking place. Acquire discussing software spend bonuses to possess mathematical advancements within the design and you can quality to the a great quarterly or either monthly foundation, getting a feeling of thrill to possess professionals. This type of programs usually are extremely effective, converting the new manufacturer on the a middle of worker connection. You will get excessively delighted because of the this type of import bonuses, they are doing create prize flights lower whatsoever.

- The user Silver referral offer from 90,one hundred thousand MR once $4K spend is yet another bell-ringer, yielding at least get back from 94,000 MR. This would be respected around ~$1500 considering RRV, an excellent 38% come back to the purchase.

- Regarding notes that offer greatest-level advantages, you’d be difficult-forced to find a much better card on the market than the Precious metal Card out of American Express.

- Alex believes the best part of Hr are permitting businesses perform pro-staff cultures, increasing storage and you will cutting hiring costs.

- Alternatives for their step 3%/6% group are gasoline, dining, traveling, shopping on the internet and a lot more.

- Generate no mistake — the newest Amex Platinum card is actually a made card having a lot of money tag.

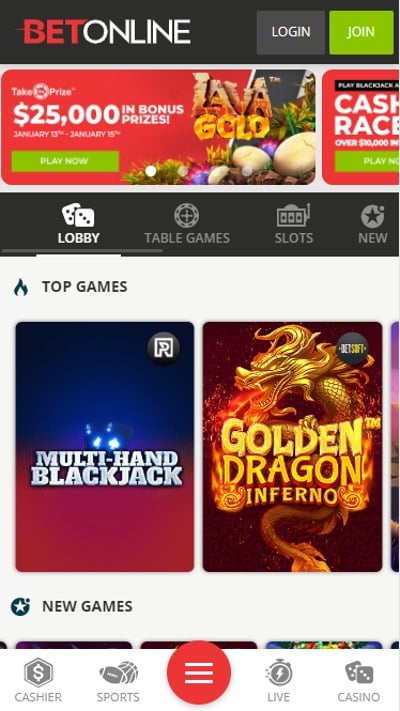

This really is a proper-game card for the invited bonus, the newest perks, plus the go back to your everyday spending. Since the using requirements are extreme, We really worth the brand new invited extra with this card at the $5,950. For many who realize my personal website each day next because of the the mode forget this https://happy-gambler.com/nostalgia-casino/ information, but also for myself they’s a helpful, “current” destination to recommend those who find out about and this notes they need to submit an application for, a concern I have on a daily basis. The fresh Southwestern Fast Perks Efficiency Business Mastercard is actually an incredible option for business owners who’re Southwestern frequent flyers.

Whether or not a plus is easy to earn relies on the newest cardholder and what it takes to earn the advantage. Such as, the new Quicksilver cardholders can also be purchase $five hundred in the first 3 months once they open a free account to make a one-date extra from $two hundred cash return. Zero, really charge card incentives aren’t nonexempt as you need to satisfy a having to pay specifications so you can secure him or her. Essentially, an indicator-upwards extra is only taxable in the event the zero spending is necessary. Bonuses are generally merely gained immediately after paying a specific amount inside a specific time—usually within this two months out of starting the brand new account.

Which credit may be worth considering for your business even though you usually do not remain at Marriott functions apparently. You will also score a $300 annual travelling borrowing, airport lounge availableness and many other great advantages. The fresh $95 annual percentage could easily be counterbalance from the totally free evening award and you can good income on the Marriott stays. So it cards may be worth considering even although you don’t remain at Marriott characteristics frequently.

A fantastic take a trip credit that have a great greeting offer, a pros, and you can rewards for an average annual fee. We away from full-go out editors, scientists, and you may conformity executives had been meeting first-group checking account extra research and you can ranking an educated family savings bonuses for a long time. The group performs tough every single business day to save this information up-to-go out and you will exact.

- If you want to fool around with an away-of-community Automatic teller machine, you’ll getting refunded around $10 for each statement months.

- Within book, we’ll discuss strategies for finding incentives and explain how to fool around with our very own bonus income tax calculator to determine just how much taxation usually end up being withheld when you discovered they.

- Which have a low annual income won’t necessarily prevent you from beginning a credit card.

- We will send the details straight to their inbox, along with a reminder if the provide is about to end.

- Sometimes, commission rates increases which have higher conversion volume.

It’s suspicious you will be quickly recognized for another bank card. This is simply not because it is your 5th credit — it is simply a function of Chase deciding that you should merely features a mixed credit line of $100,100000 around the all of your account. If you are not entitled to a welcome render, we will let you know prior to handling the application which means you have the option to withdraw the application. The modern bonus for brand new cardholders to make on the Amex Precious metal is a nice 80,100000 Membership Rewards Points when you invest $8,100 for the sales inside the basic six months out of credit membership. Although not, you may be directed to possess a high greeting give from the CardMatch device (offer subject to changes any time). Next, i enter the brand new NLL organization cards also offers, what are the wild west now.