Mastering Exness Day Trading Strategies and Insights

Mastering Exness Day Trading: Strategies and Insights

Day trading is one of the most dynamic forms of trading in the financial markets, and when done effectively, it can lead to significant profits. Among the various platforms available for day traders, Exness has emerged as a popular choice due to its user-friendly interface and extensive features. In this article, we will explore the essentials of Exness Day Trading https://tdih.co.zw/revision-general-de-exness-12/, providing insights, strategies, and tips to help you navigate this exciting endeavor.

Understanding Day Trading

Day trading involves buying and selling financial instruments within the same trading day. Day traders aim to capitalize on short-term market fluctuations, often holding positions for just minutes or hours. This trading approach requires a solid understanding of market trends, real-time analysis, and quick decision-making skills.

Advantages of Using Exness for Day Trading

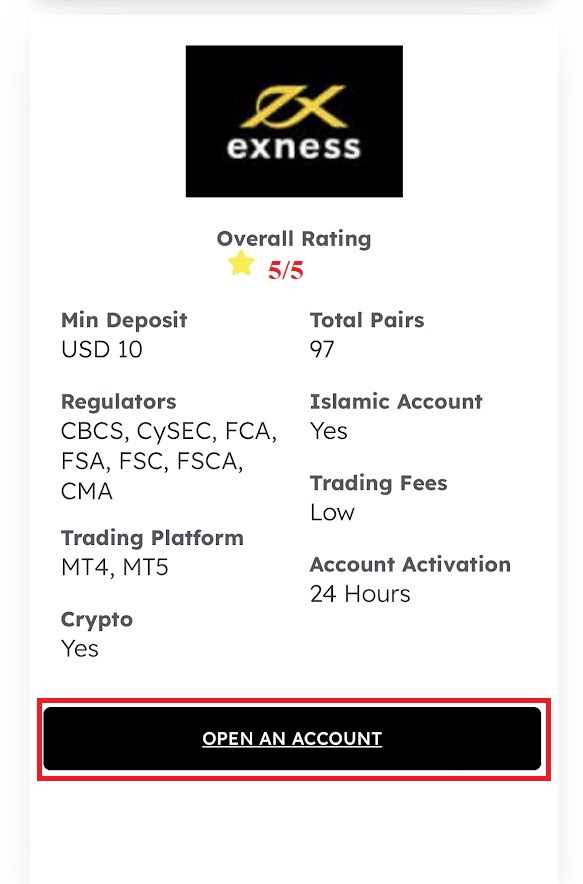

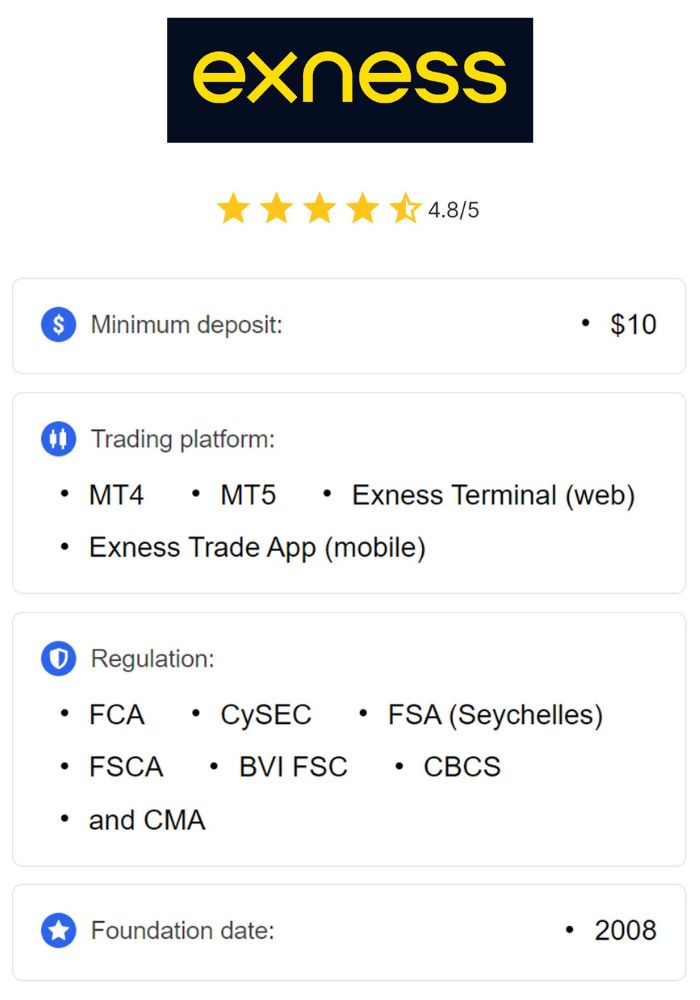

Exness stands out among online trading platforms for numerous reasons. Firstly, it offers a wide range of trading instruments, including forex, commodities, and cryptocurrencies, allowing traders to diversify their portfolios. Secondly, Exness provides competitive spreads and leverage options, which can maximize potential profits. Finally, its intuitive trading interface and advanced analytical tools make it suitable for both novice and experienced traders.

Setting Up Your Exness Account

To begin day trading on Exness, you need to create an account. The registration process is straightforward:

- Visit the official Exness website.

- Click on the „Open Account” button and fill in the required information.

- Choose the type of account that suits your trading style (Standard, Pro, or Cent).

- Verify your identity by providing the necessary documents.

- Deposit funds using one of the many supported payment methods.

After your account is set up and funded, you can download the Exness trading platform or use the web version to start trading.

Key Strategies for Successful Day Trading

Successful day trading requires discipline, strategy, and a thorough understanding of market dynamics. Here are some crucial strategies to consider:

1. Trend Following

This strategy involves identifying market trends and making trades in the same direction as the trend. By analyzing price charts and technical indicators, traders can spot entry and exit points that align with the prevailing market movement.

2. Scalping

Scalping is a popular day trading strategy that aims to generate small profits from numerous trades throughout the day. Traders who use this approach typically hold positions for just a few seconds to minutes, relying on quick decision-making and execution.

3. Momentum Trading

Momentum trading focuses on stocks or assets that are moving significantly in one direction with increased volume. Day traders utilize this strategy to capitalize on rapid price movements by entering trades early and exiting for profit as momentum shifts.

Risk Management Techniques

Effective risk management is crucial in day trading. Here are some techniques to help you protect your capital:

- Use Stop-Loss Orders: Set stop-loss orders to automatically close your position if the market moves against you, minimizing potential losses.

- Position Sizing: Calculate the size of each trade based on your overall account balance and risk tolerance to avoid risking too much on a single trade.

- Avoid Over-Leveraging: While Exness offers high leverage, it’s important not to over-leverage your trades, as this can lead to significant losses.

Utilizing Technical Analysis

Technical analysis is a critical component of day trading. By studying historical price movements and using various technical indicators, traders can make informed decisions. Some of the most common indicators include:

- Moving Averages: Help identify the direction of the trend and potential reversal points.

- Relative Strength Index (RSI): Determines whether an asset is overbought or oversold.

- Bollinger Bands: Measure market volatility and can signal potential price reversals.

The Importance of a Trading Plan

A well-defined trading plan is essential for success in day trading. Your plan should outline your trading goals, risk tolerance, entry and exit strategies, and guidelines for managing your trades. By following a consistent plan, you can eliminate emotional decision-making and enhance your trading performance.

Keeping Up with Market News

Staying informed about economic news and events is vital for day traders. Market sentiment can shift dramatically based on news releases, earnings reports, and geopolitical events. Utilizing news aggregation platforms and calendar tools can keep you ahead of the curve and help you make timely trading decisions.

Continuous Learning and Adaptation

The financial markets are constantly evolving, and successful day traders understand the importance of continuous learning. Regularly review your trades, analyze what worked and what didn’t, and seek out educational resources to improve your skills. Additionally, adapting to changing market conditions and adjusting your strategies is key to long-term success.

Conclusion

Exness Day Trading can be a rewarding venture for those willing to invest the time and effort to learn and adapt. By following the strategies outlined in this article, practicing sound risk management, and maintaining a disciplined approach, you can enhance your trading performance and work towards achieving your financial goals. Remember, day trading is not a guaranteed way to make money, but with the right mindset and tools, it can be a fulfilling and profitable activity.