Uk household notes: For those who have pre-settled otherwise compensated position

Articles

This region might be cutting-edge, therefore it is constantly well worth bringing advice before carefully deciding for the whether or not to state the money or not. Explore an alternative solution to check on someone’s right to work or to view the to rent. When you are deported in the British their indefinite exit usually getting invalidated. Type of election, referendums, and you will who’ll choose will bring details about if you could potentially choose in the uk.

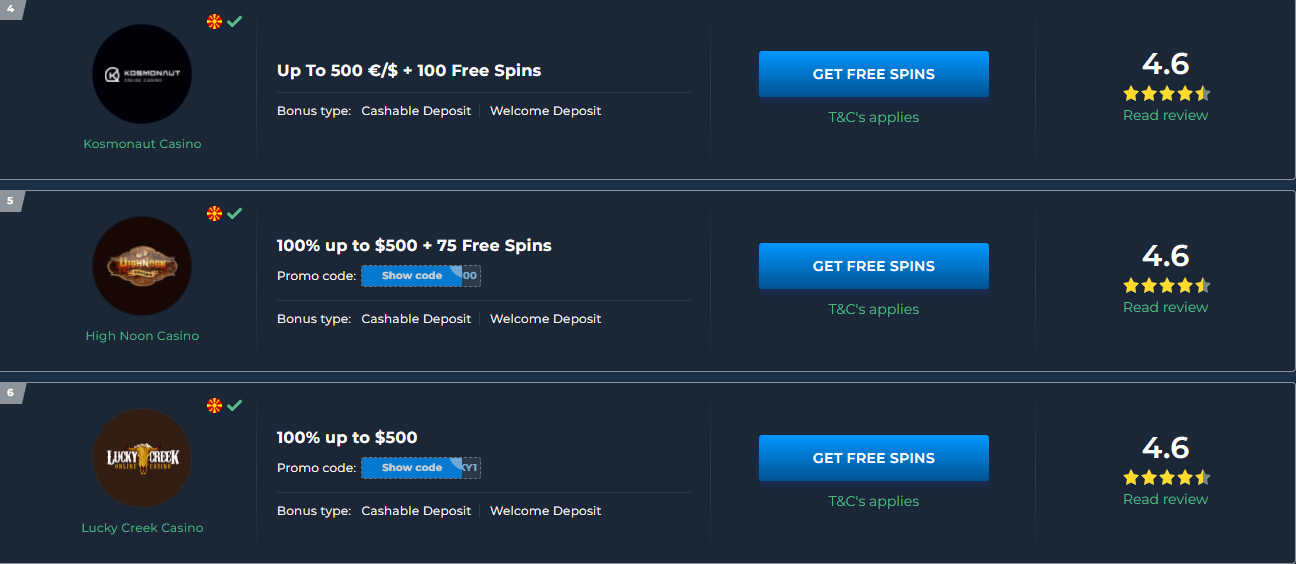

A lot of key factors will establish whether you ought to over a tax come back, as well as the supplemental models required, and you should usually seek expert advice to quit people punishment or twice tax. Digital banking institutions render quicker charges, increased interest rates, and you will benefits. Yet not, a prospective disadvantage is that electronic banking institutions might not supply the comprehensive financial services obtainable in conventional banking institutions. Nevertheless, they offer a practical alternative for low-owners who has difficulties starting a traditional bank account. Grasping the needs and qualifications requirements is an essential step in the procedure of opening a non-citizen United kingdom bank account.

Once you’ve been related to one of our partners, you’re welcome so you can guide a free of charge discovery call in order to discuss your situation that assist your present whether or not you want assist with your income tax get back. When you’re selling a great Uk assets, for example home, you might need to at the least statement the brand new selling of your own property, even if no tax arrives. This article talks about the basics to Notice Assessment Tax statements and the a lot more details and you may forms non-owners might need to take into account. This service membership will teach whether they have the authority to alive in the uk, and you may one limitations on their legal rights otherwise access to benefits and characteristics. If you have children in the united kingdom when you’re compensated here they are going to normally be an uk citizen instantly from the birth.

You are able to utilize the expired document to search to your British ahead of or to your step one Summer 2025, offered you’ve still got consent to remain in the uk. When you’re deemed a great United kingdom taxation citizen for an income tax year, you can even have the choice in order to be eligible for split 12 months medication. Split season medication enforce around your disperse so you can or hop out the uk, allowing you to be taxed since the a low-United kingdom citizen inside to another country part of the seasons for certain tax conditions. One of many very early fashion inside immigration in the 2025 might have been a boost in the house Work environment doing compliance monitors for the joined sponsors holding Skilled Worker and you will Global Company Versatility licences. Talking about no more restricted to help you inside-individual audits, as an alternative, businesses are getting asks for data files and suggestions because of the current email address. Theoretically this process should make appearing the to alive in britain smoother, however with all new technical one thing this can make the Home Workplace time and energy to metal away all kinks which come right up in the process.

Access to healthcare

Consider, the key to a successful banking experience in great britain try knowledge your position, looking around vogueplay.com use a link , and you may and then make informed behavior. Using this type of book, you’lso are on your way so you can economic stability on the the newest family. The financing an incredible number of low-citizens will likely be significantly dependent on their banking options.

In the united kingdom, your domestic reputation isn’t a fixed layout—it’s something which changes throughout the years considering your chosen lifestyle, elite requirements, and private choices. If a All of us citizen’s domestic position in britain alter, it’s essential to inform this information which have HMRC. If you are non-citizen, you will simply be able to over your own income tax return on the web when you have special app that allows they. For the reason that the new supplemental versions that will be required by low-residents, specifically the fresh SA109 form, can’t be submitted using HMRC solutions myself. United kingdom tax experts usually, however, have access to the program must file online.

Business Banking Alternatives to own Low-United kingdom Residents

Some people wrongly think that while the income tax has been paid in by far the most legislation, no tax is due in the united kingdom. This may or not end up being the instance, but accurately interpreting the new complex income tax treaties is paramount to once you understand what you should just need to pay tax in one to legislation as well as the right way to report taxes to prevent twice tax. The newest tax go back have a tendency to allow HMRC to determine how much income tax you borrowed from in the uk, otherwise one rebates which are due to you, out of money you acquired inside tax 12 months below opinion.

Is a non-resident provides an excellent Uk bank account?

Basically, spent your day in the united kingdom if you are in the the country at midnight – talking about named qualifying days. Expats just who invest 183 months or maybe more in the united kingdom to possess one tax year try Uk citizen for everybody one seasons and you can cannot make Legal Residence Try. We simply cannot render immigration suggestions about personal software after you get in touch with you. While you are a susceptible individual, you are able to find additional help to manage a good UKVI account and you will availableness your eVisa. If the BRC awarded underneath the Eu Settlement Strategy ended to your or after 30 December 2024, therefore continue to have consent to stay in the united kingdom, you will want to take it along with you once you go the fresh British until 1 Summer 2025.

As an alternative, you could posting desires for the Customer Compliance Movie director if your company’s tax issues try taken care of from the Large Team. If not, then you definitely is to posting your own needs for the Business Taxation Characteristics office. You’ll usually end up being managed while the United kingdom citizen in every tax 12 months if you are in person found in great britain for 183 months or more in this year. With regards to depending weeks, it indicates you’re in person present in the united kingdom at midnight for the 183 weeks or maybe more. Anyone could have been a good Uk citizen for around 15 of your own 20 income tax decades instantaneously through to the related income tax year where the computation try taking place. When you’re Professionals to own Expats doesn’t personally provide advice of every form our lovers i work on is actually managed by suitable government.

You skill which have an ended BRP

Various other posts, Dusk Golem states Resident Evil 9 is actually ‘customized as the a 3rd-people video game’, which acquired’t have the first-individual angle of Citizen Worst Community. Nonetheless they allege it does discharge in the 2026, even if Capcom’s latest economic records suggest it might be a while after March. Even though it isn’t stated explicitly, it’s intended the brand new multiplayer element try fell too – because factor has never been discussed earlier.

Expertise such points as well as how they interact is essential to completely leveraging the advantages of your home-based position since the an enthusiastic expat. Whenever talking about including intricate issues, consulting with a professional can help to navigate the causes and ensure you’re enhancing your role. HMRC not one of them most people living in the uk to accomplish a good Uk tax come back each year, but rather their income tax is basically paid off and modified as a result of the person’s PAYE (Spend since you Secure) income tax coding. Just after accepted HMRC have a tendency to alert your own enabling representative to discharge rents for you with no withholding income tax. You might be inserted so you can document an income tax return and you may required so you can statement their rental money and costs on the an annual basis. In some instances you will have a good double tax treaty between them countries away from home that ought to remember to essentially usually do not shell out full taxation double for a passing fancy money otherwise financing progress.

Travel away from Uk

The proper execution to register as the a low-citizen property owner and make certain your acquired rents gross are setting NRL1 ‘App to receive Uk leasing money rather than deduction of Uk tax – individuals’. For Uk Expats who were low-citizen for some time, defined as anyone who has perhaps not already been United kingdom taxation citizen in the any of the prior three British income tax decades, the newest “arrivers” testing usually implement. You exercise your residence reputation to own funding progress (for example, after you sell offers or an additional household) in the same way because you create to have income. For individuals who’lso are however being unsure of regarding your position, you can utilize the new home condition checker. This may leave you an indication of whether or not you used to be a great United kingdom citizen in just about any taxation year away from 6 April 2016. If you do not use your passport to get use of your eVisa, you’ll must improve your UKVI account along with your passport facts before you can use your eVisa to journey to the united kingdom.

After you’ve become a citizen, it’s impractical you to position you’ll ever be used aside – if you don’t renounce their citizenship or commit a significant offense one provides the regulators an explanation so you can strip their rights. You can keep a passport for another country in the you to you had been born in the through the use of to own citizenship due to naturalisation or money. In essence, your own allegiance would be to your country away from delivery, which has numerous legal rights (and you will a duty otherwise a couple of). It all depends on the day you leftover the nation, so you tend to fall into separated 12 months medication that will category your since the resident to possess area of the seasons and you will low-resident on the rest.

The brand new sufficient days attempt try a great five-action formula to see if an expat functions fulltime to another country. HMRC tend to take a look at an enthusiastic expat rating more than thirty five on the sufficient times test as the operating full time overseas. There will be a country tie to the British if you have the united kingdom at nighttime to your higher amount of months regarding the income tax 12 months.